I’ve been expecting this, but it was still a shock to see the headline this AM.

Russia has announced that “hostile” nations will have to pay for gas in rubles.

I have seen a rumor that Russia will expand this ruling to include all exports to Putin’s “naughty list”. If they follow through, this is a big one.

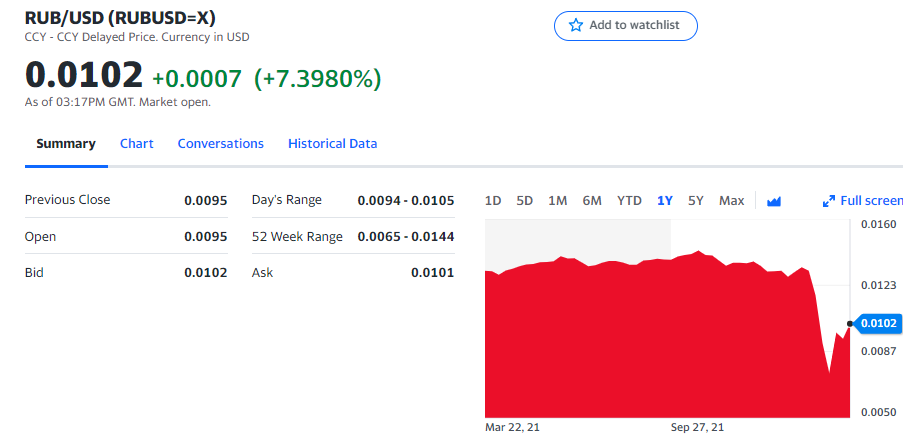

The ruble jumped 7.3% vs the dollar this morning. It is still down significantly since the start of the conflict, but will be interesting to see how it trades in coming weeks.

On a side note, the Moscow Stock Exchange is finally slated to open partially tomorrow Thursday March 24. I will be curious to see where shares open, and how they trade. It seems likely the initial direction, at least, will be sharply downward.

Germany and the EU

To understand some of the direct effects, let’s look at Germany, the heart of industrial Europe.

While it is home of some of the world’s finest engineering, Germany has negligible energy reserves. So it currently imports massive amounts of energy and commodities. Russia is its largest provider by far.

From The Guardian’s Boycott of Russian gas and oil ‘could cause mass poverty in Germany’:

The Green party politician predicted “mass unemployment, poverty, people who can’t heat their homes, people who run out of petrol” if his country stopped using Russian oil and gas.

Few other western economies are as dependent on Russian energy as Germany: 55% of the natural gas, 52% of the coal and 34% of mineral oil used in the country comes from Russia, for which it pays hundreds of millions of euros daily, financially supporting the war machine currently devastating Ukraine.

Longer-term, one of US/NATO’s primary concerns is that pressure will grow in Europe to normalize relations with Russia. The allure of cheap, plentiful energy and commodities will be strong.

Russia and China will likely attempt to bring Germany and other EU states into their new Eurasian alliance. It will be a tough sell, at first, but if prices continue to soar and the economy crumbles, even the unthinkable becomes possible.

Multiple Reserve Currencies

This is quite the historic moment. The dollar’s role as the primary reserve currency of the world is waning. Inflation could get bad for a while. Living standards around the world will almost certainly fall near-term, particularly in the US and EU.

It seems clear there will be multiple reserve currencies going forward. Yuan, dollar, euro, and… ruble? Rupee eventually? A multipolar monetary system is suddenly possible, even probable.

Eventually I expect much of the world will return to a gold standard of some sort. It’s no coincidence that China and Russia have been stacking bars for 10+ years.

In response, we must begin rebuilding American manufacturing capacity. Ramp up commodity and agricultural production, fracking, drilling, wind, and solar. It’s our best shot. Even so the transition period is likely to be a painful one. And that’s assuming our government acts in a somewhat rational fashion.

Confused?

If you’re struggling to understand how we got here, and why the dollar is suddenly not the rock-solid reserve asset it once was, I recommend reading Nic Carter’s America’s Quiet Default. It is a masterpiece. Here’s the gist.

First, the U.S. seized Afghan central bank assets held in New York and bizarrely handed a large portion over to the plaintiffs in a 9/11 lawsuit. While the seizure may have been predictable, expropriating the savings of ordinary Afghans and distributing them to Americans affected by 9/11, an attack perpetrated by Saudis, is deeply unusual. Partly as a consequence, the Afghan banking system is keeling over, worsening a humanitarian crisis.

Not content with that, Biden then dropped a financial nuke on Russia with the seizure of her reserves.

While seizing Afghan or Russian reserves may feel righteous and just, the immediate effect of such actions is to completely undermine the credibility of dollar debt as an international savings device.

Underestimating the New ‘Eurasian’ Alliance

I am increasingly of the opinion that we underestimate Russia at great peril. They may come out of this with a lot more power than most people in the West expect.

This recent Twitter post by a spokesman of China’s Foreign Ministry was telling.

Russia appears to have a de facto alliance with China, India, Venezuela, and most of the Middle East. Now is not a time to dismiss these emerging world powers, especially when they control so much of the world’s oil, gas, and manufacturing.

China and Russia have grown worryingly strong military capabilities. Russia’s regular use of hypersonic (mach 10) missiles during the invasion of Ukraine, to which the West has no good answer to, is noteworthy.

Russia’s hypersonic weapons such as the Iskander and Khinzhal are serious threats. They have been used to take out heavily-defended targets such as oil and weapon depots in Ukraine, and have successfully evaded competent Ukrainian air defenses, such as Soviet Buk missile systems.

As far as I know, we have no real defense against them. Patriot Missiles would certainly swing and miss. Maybe we have some top secret superweapon. But either way, the US military is rushing to catch up with modern missile tech, and we are far behind.

Of course, direct war between nuclear powers simply isn’t a realistic option. Somehow, diplomacy must win out.

I don’t know if Europe is going to have a choice but to support the ruble, and add it to their reserves, in order to keep the lights on. There simply isn’t enough energy available to replace Russian sources.

The US, with its large domestic oil and gas reserves, is in a stronger position than our EU partners. Still, we may struggle without Russian fertilizer and tertiary petroleum products.

In Europe the potential implications are so large they are hard to fathom. And the indirect effects on the dollar and eurodollar systems will be material.

Find more analysis of the de-dollarization situation in yesterday’s Bitcoin-Gold Barbell piece. Also see my article for The HIVE Newsletter titled Has De-Dollarization Begun?